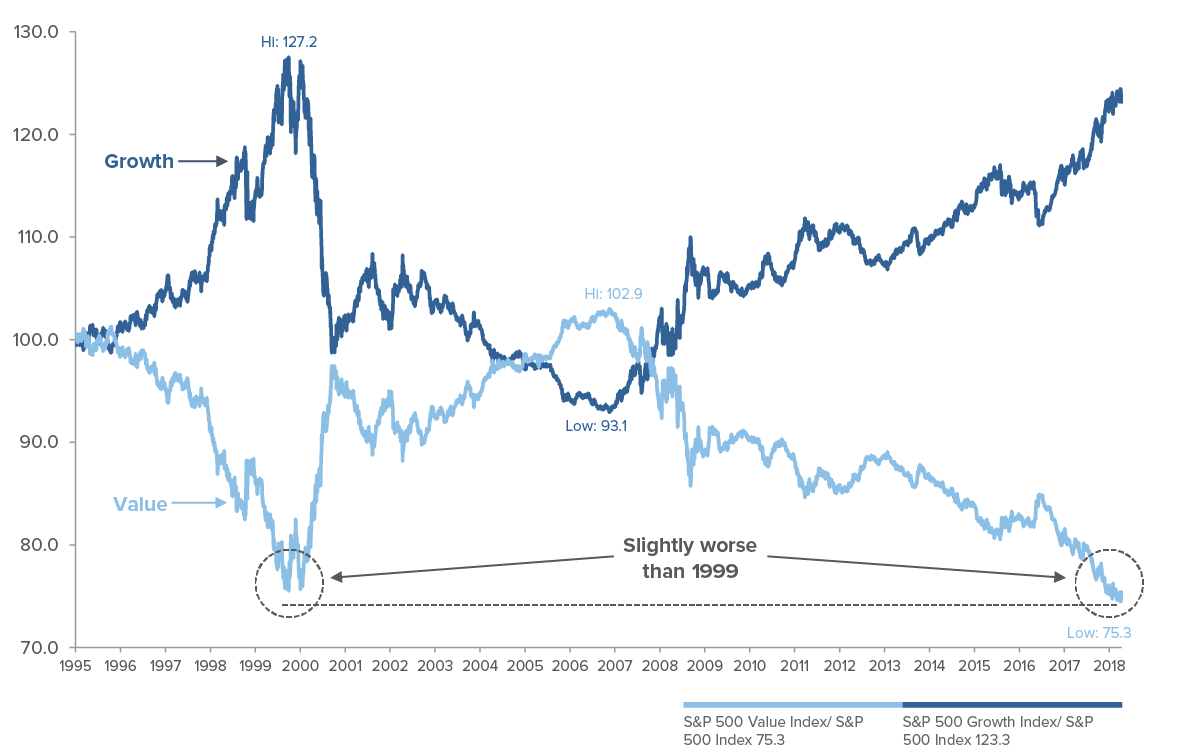

Value Stocks are Screaming for a Reversion to the Mean. Is Anyone Listening? - Insights - Westwood Wealth Management

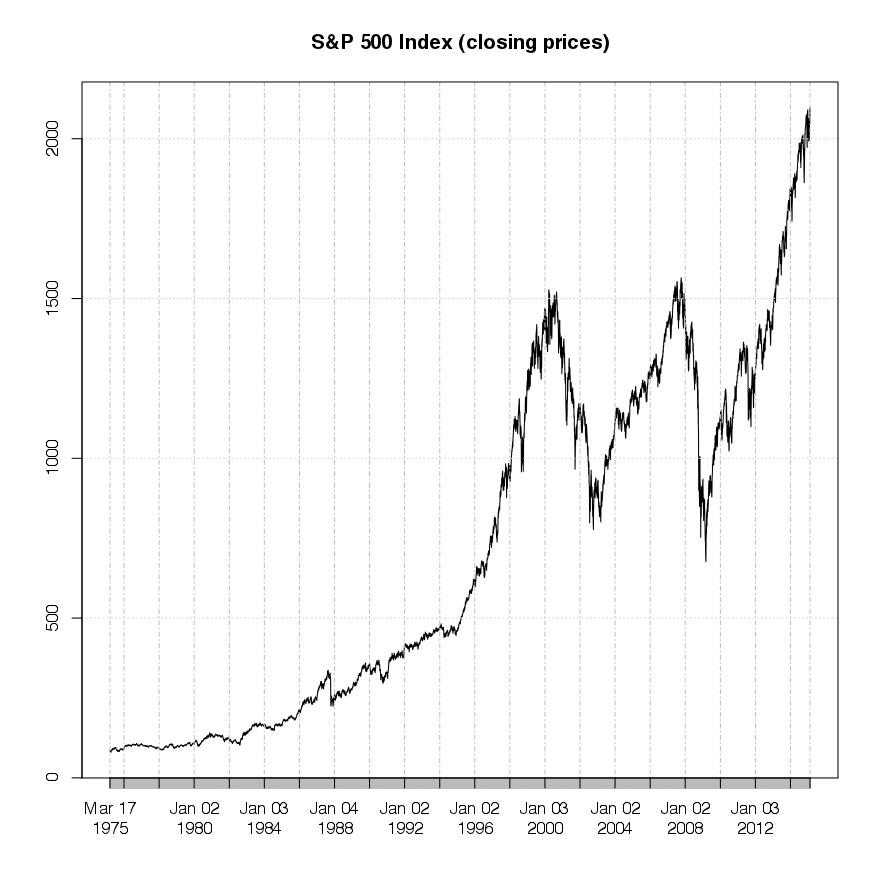

the real S&P 500 index always comes back to its exponential growth line. This is going to be the biggest correction anyone has ever witnessed. Are you ready for take off? :

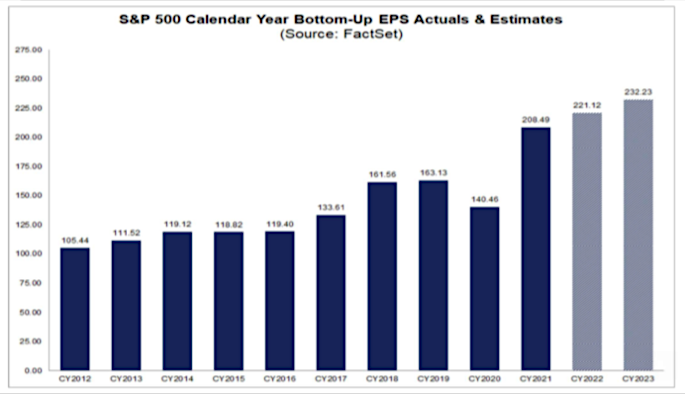

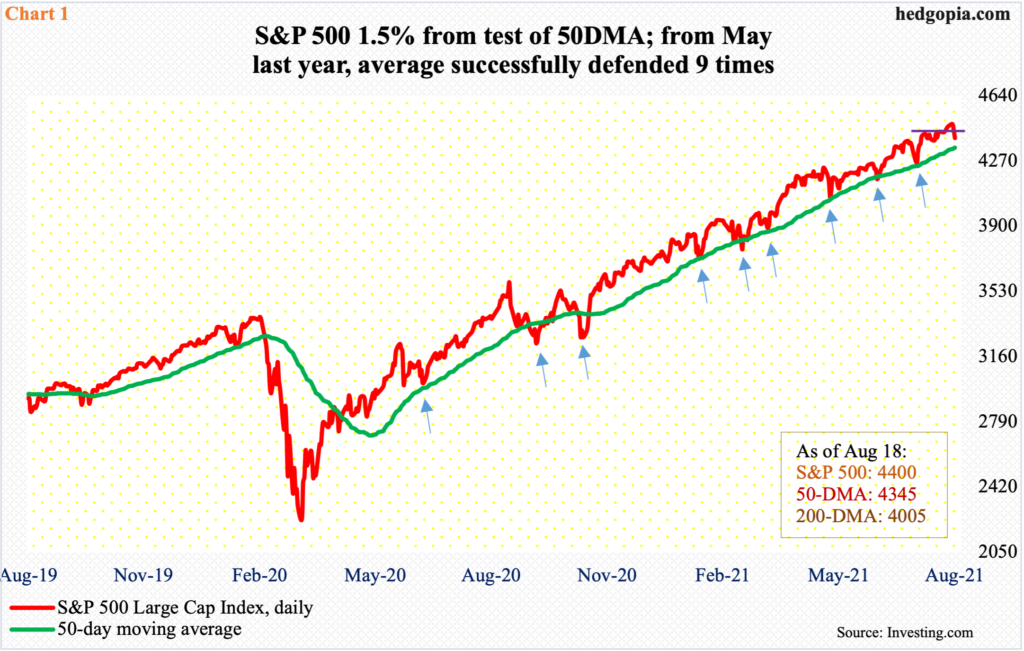

S&P 500 Earnings Look Very Good On Absolute Basis, But Growth Rate On Pace To Rapid Deceleration Soon – Hedgopia

If the S&P 500 is said to grow by around 7% each year, then why does its price grow linearly instead of exponentionally? - Quora

Why stock-market bulls are 'woefully myopic' about S&P 500 profit growth --- even before the impact of a potential recession - MarketWatch

Third-Quarter S&P 500 Earnings Are A Potential Springboard To Sustained Double-Digit Corporate Earnings Growth | S&P Global Market Intelligence

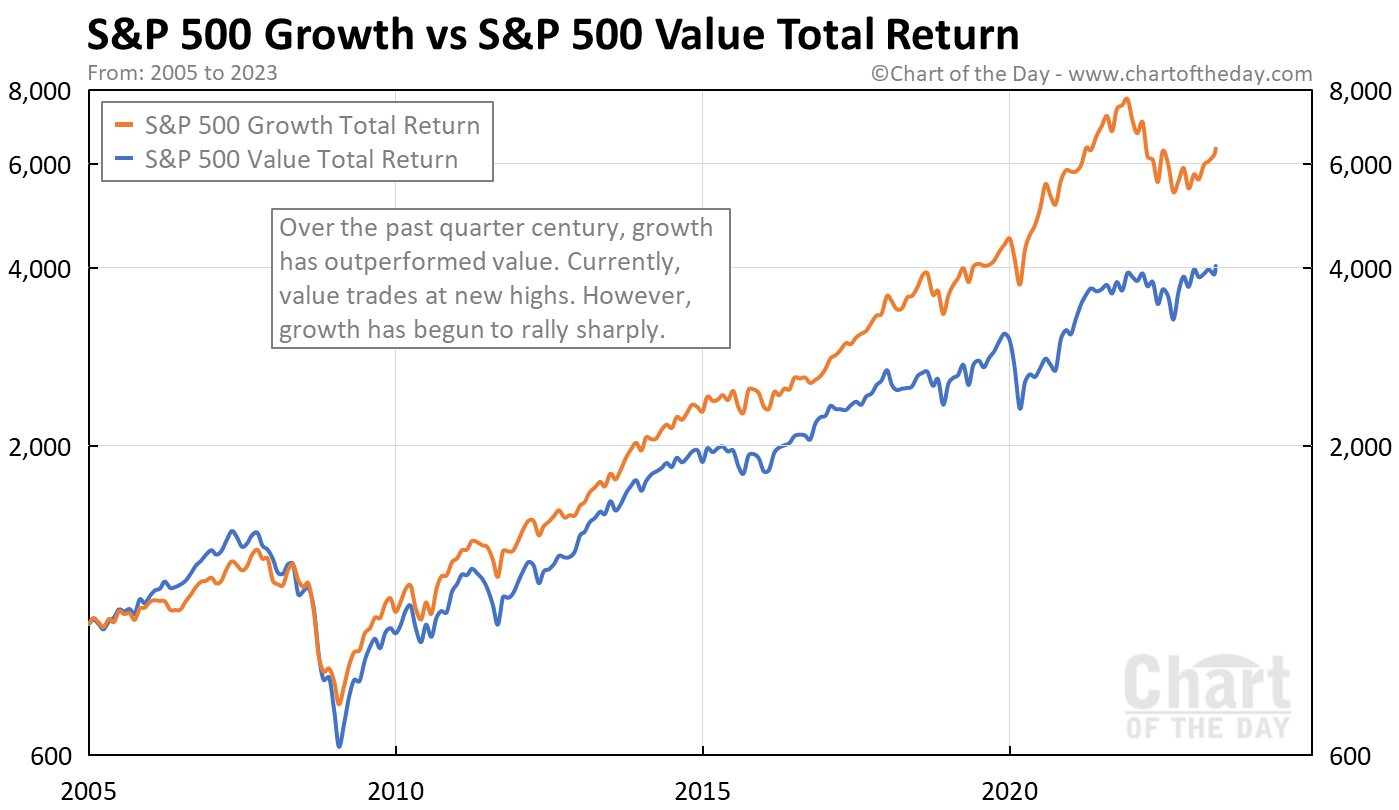

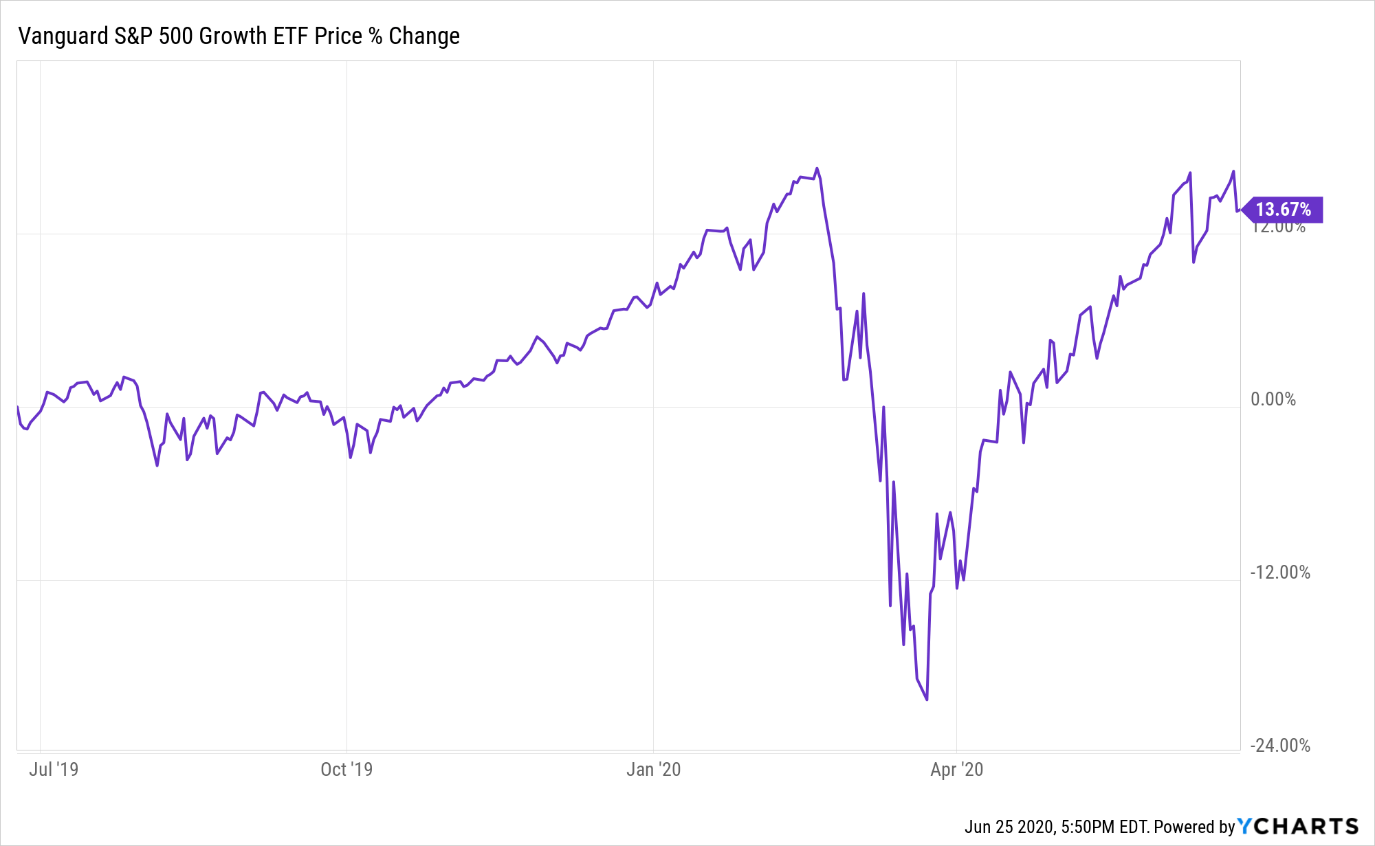

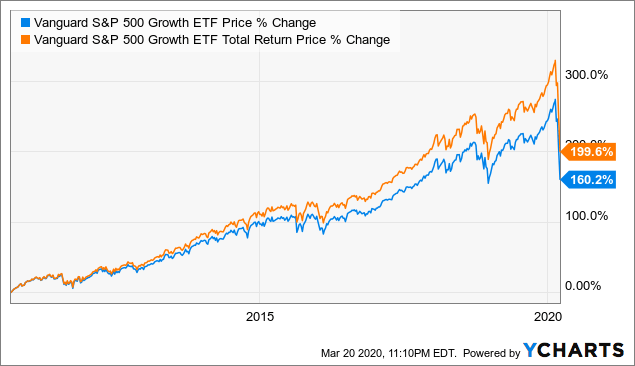

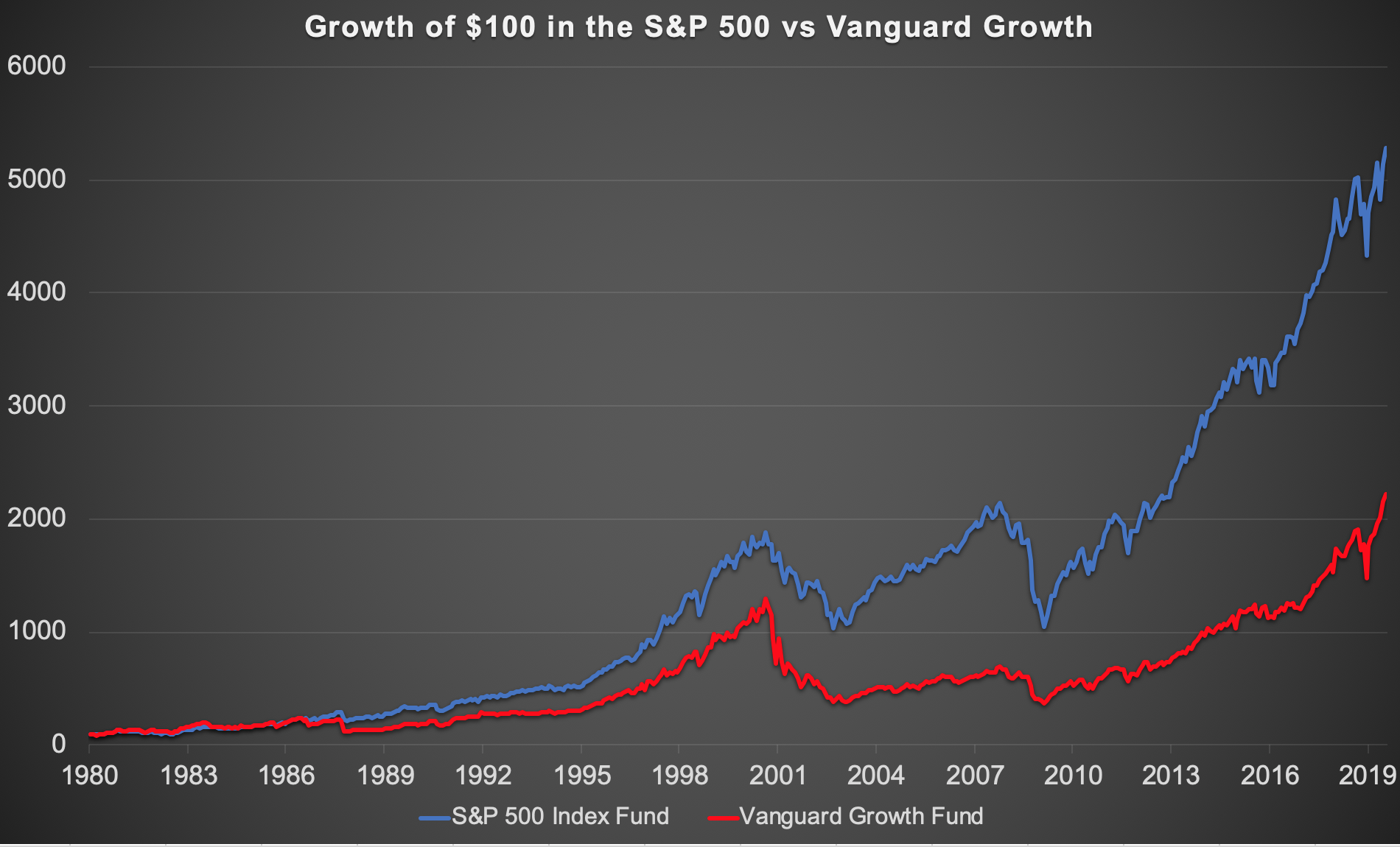

Vanguard S&P 500 Growth ETF: Best Passively Managed Fund For Long-Term Growth Investors (NYSEARCA:VOOG) | Seeking Alpha

Vanguard S&P 500 Growth ETF Is Now Undervalued But Visibility Is Still Limited (NYSEARCA:VOOG) | Seeking Alpha

Insight/2021/08.2021/08.09.2021_TOW/sp500-revenue-growth-5-year.png)